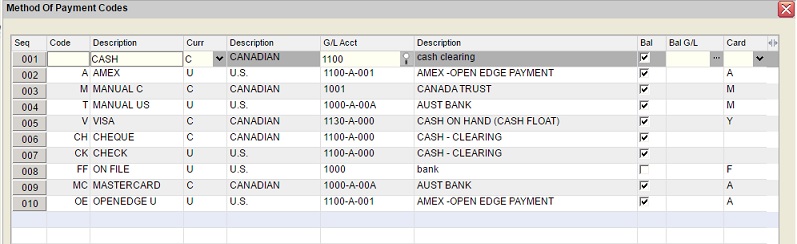

- CODE

- Enter a code for Method Of Payment up to five characters.

e.g. V for VISANote:

Payment codes starting with RWD- are reserved for Reward Dollar payments and cannot be used in this table.

Refer to Reward Program Maintenance for more information on configuration and use of this feature.Payment codes starting with TBD- (To Be Determined) are used by Texada Pay and are suffixed with -M for a Manual card capture or -A for a Terminal scan card automatic capture.

The TBD-M, TBD-A, and FILE* codes are reserved and cannot be setup in this table.

DESCRIPTION- Type in the description for this code.

e.g. VISA

CURRENCY- Enter C for Canadian, U for U.S., or A for Australian

funds.

The currency will default from the currency selected in Company Information.

G/L ACCOUNT- Enter the G/L Account to be debited with this Method Of

Payment, or select it from the drop-down list.

Normally, a Cash Clearing Account (type ASSET) is selected as explained in the section on USING A CASH CLEARING ACCOUNT above.Note: A G/L account defined as a sub-ledger Control account or as a Reward Dollar Deferred Revenue account, cannot be used for payment postings.

Control accounts for A/R and A/P and Reward Dollar posting accounts are setup by currency in Default Accounts.

DESCRIPTION- The description of the G/L Account displays.

BALANCE- This prompt applies only if the option to automate the daily

Cash Out" process generating G/L postings to clear the clearing

accounts in Daily Close 1 , has been

activated in the Company Daily Close

Parameters.

Uncheck this box if this method of payment should NOT be included in the daily cash reconciliation.

Check this box to include this method of payment in the cash balance process in Daily Close 1.

BALANCE G/L

The Balance G/L window is provided for "Cash Balancing" payment methods to capture the following Cash Over/Short information:-

- BANK ACCOUNT

- Enter the G/L account for the Bank for this payment method, or

select the account from the window.

When posting the cash reconciliation for the day in Daily Close 1, the clearing entries for the deposit amounts are automatically made, debiting this bank account and crediting the Payment Method G/L account.

EXPENSE PERCENT- If this payment method is a Credit Card where a percent fee is

paid when the deposit is made, enter the expense percentage.

e.g. Enter 2.0 for 2%

EXPENSE ACCOUNT- Enter the G/L account to be debited for the credit card expense

percentage, or select the account from the window.

The postings for the clearing transaction would then credit the clearing account for the full amount of the deposit, and debit the bank for that amount less the expense percentage, and debit this expense account for the percent fee.

INCLUDE IN BANK DEPOSIT REPORT- Check this box if this payment method should be reflected in

the "Deposits Report" by customer printed with the 'Cash

Over/Short Reconciliation Report' from Daily Close 1.

Uncheck this box to omit this payment method from the "Deposits Report".

Bank Account by Division- If both the Cash Over/Short and the Post DBR by

Division features are activated in the Company Daily Close Parameters a separate bank

account can be assigned by the division for each method of payment.

Enter each Division and the corresponding G/L Bank Account.

If no bank account is assigned to a division, the general bank account entered above is used for the posting.

-

CARD- Leave this field blank if this payment method is Cash or Check,

and no credit card information is required.

The Issuer does not apply and so the "Issue" drop-down box is disabled.If this method of payment requires credit card or banking information to be processed, enter one of the following codes, or select one from the drop-down list provided:

- Y (YES) to both enter the credit card information and the authorization number manually.

-

S (SCAN) to use a credit card scanner to read the credit card information, but to enter the authorization number that processes the payment manually.

With this payment type the credit card information can still be entered manually, if for some reason the scanner is unable to read a customer's card.

For information on setup of a standard scanner refer to Credit Card Scanners. -

A (TEXADA PAY TERMINAL OR BY ISSUER) to use a card scanner to read the debit, Interac, or credit card information, and to process the payment automatically through an authorization service with Texada Pay.

For information on employing a bank or credit card authorization service, refer to the Texada Pay in the Software Integration. -

M (TEXADA PAY MANUAL OR BY ISSUER) if Card or Banking information is required but the scanner is not available or the card cannot be read.

This payment type provides the ability to type in the Credit Card or Banking information.Texada Pay:

When the Texada Pay processing is activated the M payment type will trigger both the Manual card entry and the select a Credit Card or Check "On File" process captured through Capture Card/Check on File.

The Manual option does not apply to Debit or Interac cards. -

FILE* (ON FILE) to apply a validated Credit Card or a Direct Payment Check transaction that has been captured in the Capture Card/Check on File utility and saved in the Customer Credit Card table, and then when the 'FILE*' payment type is entered the Card/Check can used for subsequent payments.

This option only works with the Texada Pay processing and does not apply to Debit or Interac cards.Note: This payment method FILE* is a "virtual" payment method and is not displayed in the table, but it is displayed in the drop-down list on the 'Method of Payment' field when applicable and it can be used to pay by a 'Card/Check on File'.

Authorize Only - Deposit:

If Y (YES) or S (SCAN) options are selected, then the Default Authorization Only Prompt for Credit Card set in the Divisional Miscellaneous Parameters is respected as a default and can be over-typed for each payment as required.

Refer to Capture Customer Payment Options for details on Authorize Only for a Deposit.

ISSUE- With Texada Pay the Issuer identifies

the Credit Card/Bank payment type and is used to match the card

information with the 'Method of Payment', from the selection made

in the Select TP Method of Payment

window.

The Issue value is used by Texada Pay -Texada Web systems and becomes is required for each payment Type M (TP Manual or By Issuer) that is setup for each issuer that your firm accepts.

It is optional for Type A (TP Terminal or By Issuer) and for SRM and for non-Texada Pay -Texada Web systems, where the ‘Issue’ value is for information only.In Texada Web with Texada Pay an Issuer can be submitted on a payment instead of a 'Method of Payment' to create the appropriate payment transaction.

But when an Issuer is submitted the first match by Currency and Card found in the 'Method of Payment' table is used so it is important to restrict the ‘Issue’ to one Card and one Currency per Issuer.The Issue values provided include:

Blank - not assigned

A - American Express

B - Bank

D - Diner's Club

E - EBT

F - FSA

M - Mastercard

S - Discover

V - VisaNote: In the Texada Pay link generated by an Email For Deposit to a customer, only cards for the same currency as the Company currency that are defined with a Credit Card "Issuer" are displayed for customer selection.

Finished?- Click ACCEPT to save and exit the window.

Setting up CASH - Method Of Payment Code:

The blank Method of Payment Code can be set to be CASH (see example

below), instead of using C for Cash, to make invoicing much

faster.

Do not setup two codes for CASH, since this can make the Cash

balancing confusing on the Daily Business Report.