Tax Code Exemption Maintenance

System Maintenance Menu -> Configure

System Settings -> Accounting Tab -> Accounts

Receivable -> Tax Codes ->

ADVANCED button -> Tax Code Exemption

Maintenance

When the Enhanced Tax processing has been activated in the

Company Taxing Parameters, this utility can

be used to manage the Tax exemptions defined on a range of

Products, Product Classes, Customers, Sites, or Services.

Filters are provided according to the type of records selected for

the update to narrow the selection range, and the tax change can be

restricted to Rental equipment, and/or Sales parts.

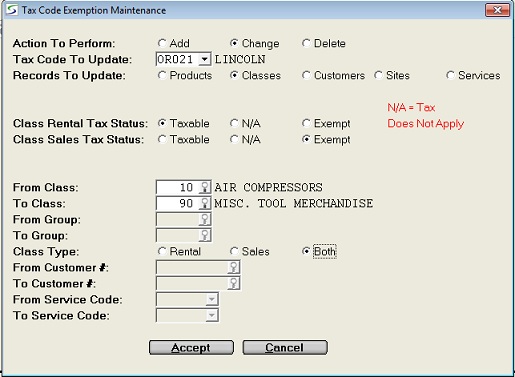

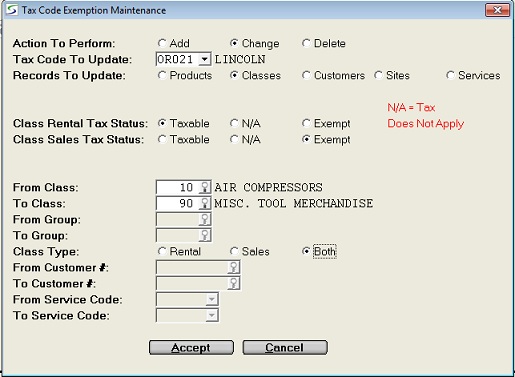

Example:

The prompts include:

-

- ACTION TO PERFORM

- Select one of the following actions:

- Select Add to add a tax code with or without exemptions

to the selected range of Records to Update.

-

Select Change to change an exemption status on existing

tax codes already assigned to the selected range of Records to

Update.

Note: No changes will be made to a Tax record if the selected

Tax Code to Update does not already exist in the specific

Tax table.

-

Select Delete to delete a tax code and any exemptions,

removing it from the selected range of Records to

Update.

TAX CODE TO UPDATE- Enter the relevant Tax Code or select it from the drop-down

list as setup in Tax Codes.

RECORDS TO UPDATE- The choice of which data tables are to be updated also controls

the filters that are provided.

Select one of the following record types and complete the associate

selection filters as follows:

-

Select Products to indicate that the tax

information is to be updated for only Rental and/or Sales Products

in the selected range.

Any changes to taxes and tax exempt information for products are

also reflected in Tax Code Overrides By

Product .

-

- PRODUCT TAX STATUS

- This prompt only applies if Product taxes are being added or

updated.

Select one of the following tax status settings:

- The Taxable option does not apply for products as only

exemptions are included in this table, and a Tax record that is

"taxable" is not relevant to the exemption file.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on documents for products in the selected range.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for products in the selected

range.

FROM CLASS- Enter the starting Product Class for the range of products or

classes to receive the tax changes, or select the starting class

from the Product Class Search

window.

- TO CLASS

- Enter the ending Product Class for the range of products or

classes to receive the tax changes, or select the ending class from

the window.

FROM GROUP- The Group selection range applies only to products.

Enter the starting Group for the range of products to receive the

tax changes, or select the starting Group from the Group Search window.

- TO GROUP

- Enter the ending Group for the range of products to receive the

tax changes, or select the ending Group from the window.

PRODUCT TYPE- Select one of the following tax status settings:

- Select Rental to make the tax changes to only Rental

products.

- Select Sale to make the tax changes to only Sales

products.

- Select Both to make the tax changes to both Rental and

Sales products.

-

Select Classes to indicate that the tax

information is to be updated for the Rental

Product Classes and/or Sales Product

Classes in the selected range.

Any changes to taxes and tax exempt information for Product Classes

are also reflected in Tax Exemptions By

Class.

-

- CLASS RENTAL TAX STATUS

- This prompt only applies if taxes are being added or updated at

the Product Class level.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

when products in the selected Product Classes are rented.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on documents for products in the selected Product

Classes are rented.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for products rented from the selected

Product Classes.

CLASS SALES TAX STATUS- This prompt only applies if Product Class taxes are being added

or updated.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

when products in the selected Product Classes are sold.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on documents for products in the selected Product

Classes.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for products in the selected Product

Classes.

FROM CLASS- Enter the starting Product Class for the range of products or

classes to receive the tax changes, or select the starting class

from the Product Class Search

window.

- TO CLASS

- Enter the ending Product Class for the range of products or

classes to receive the tax changes, or select the ending class from

the window.

PRODUCT TYPE- Select one of the following tax status settings:

- Select Rental to make the tax changes to only Rental

products.

- Select Sale to make the tax changes to only Sales

products.

- Select Both to make the tax changes to both Rental and

Sales products.

-

Select Customers to indicate that the tax

information is to be updated for the Customer

Information in the selected range.

Any changes to taxes and tax exempt information for customers are

also reflected in Tax Exemptions By

Customer.

-

- CUST RENTALS TAX STATUS

- This prompt only applies if taxes are being added or updated

for customers.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

for the selected customers when equipment is rented.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on documents for rentals to these customers.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for rentals to these customers.

CUST SALES TAX STATUS- This prompt only applies if customer taxes are being added or

updated.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

for the selected customers on sales of rental or sale

products.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on documents for sales to these customers.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for sales to these customers.

CUST SERVICES TAX STATUS- This prompt only applies if taxes are being added or updated

for customers.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

on services for the selected customers.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on document services for these customers.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for services to these customers.

CUST DMG WVR TAX STATUS- This prompt only applies if customer taxes are being added or

updated.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

for the selected customers on Damage Waiver.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on document Damage Waiver for these customers.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for Damage Waiver to these

customers.

FROM CUSTOMER #- Enter the starting customer number in the range of customers to

be updated by the tax changes, or select the starting customer from

the Accounting Customer Search

window.

- TO CUSTOMER #

- Enter the ending customer number for the selection range, or

select the ending customer from the window.

-

Select Sites to indicate that the tax information

is to be updated for the Customer Site

Information in the selected range.

Any changes to taxes and tax exempt information for customers are

also reflected in Tax Exemptions By

Site.

-

- SITE RENTALS TAX STATUS

- This prompt only applies if taxes are being added or updated

for sites.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

for all sites for the selected customers when equipment is

rented.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on documents for rentals on sites for the selected

customers.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for rentals on all sites for these

customers.

SITE SALES TAX STATUS- This prompt only applies if site taxes are being added or

updated.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

for all sites for the selected customers on sales of rental or sale

products.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on documents for sales on sites for the selected

customers.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for sales on all sites for the selected

customers.

SITE SERVICES TAX STATUS- This prompt only applies if taxes are being added or updated

for sites.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

on services for all sites for the selected customers.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on document services for sites for these

customers.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for services for all sites for these

customers.

SITE DMG WVR TAX STATUS- This prompt only applies if sites taxes are being added or

updated.

Select one of the following tax status settings:

- Select Taxable if this tax should be added to documents

for all sites for the selected customers on Damage Waiver.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on document Damage Waiver for sites these

customers.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for Damage Waiver for all sites for

these customers.

FROM CUSTOMER #- Enter the starting customer number in the range of customer

sites to be updated by the tax changes, or select the starting

customer from the Accounting Customer

Search window.

- TO CUSTOMER #

- Enter the ending customer number for the site selection range,

or select the ending customer from the window.

-

Select Services to indicate that the tax

information is to be updated for the Service

Codes in the selected range.

Any changes to taxes and tax exempt information for customers are

also reflected in Tax Exemptions By

Service.

-

- SERVICE TAX STATUS

- This prompt only applies if service taxes are being added or

updated.

Select one of the following tax status settings:

- The Taxable option does not apply for services as only

exemptions are included in this table, and a Tax record that is

"taxable" is not relevant to the exemption file.

- Select N/A (Tax Does Not Apply) if this tax should never

be included on documents for the services in the selected

range.

- Select Tax Exempt if this tax should be added to

documents and marked EXEMPT for services in the selected

range.

FROM SERVICE- Enter the starting Service Code for the selection range to be

updated by the tax changes, or select the starting service from the

Services Search window.

- TO SERVICE

- Enter the ending Service Code for the selection range to be

updated by the tax changes, or select the ending service from the

window.

Finished?- Click ACCEPT to accept.

If an Add, Change, or Delete action is processed, the actual number

of Tax records updated will be displayed on the screen.

Click CANCEL to abort and not tax tables will be

updated.

Topic Keyword: DCTX20