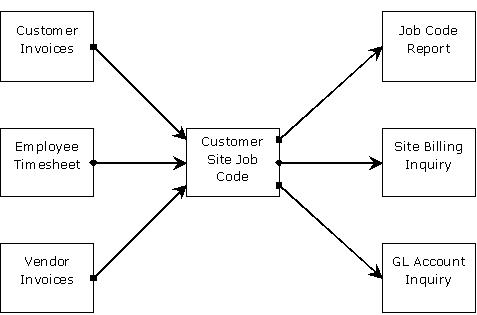

The customer/site combination is then required for all entry of revenue and expenses in order to track the costs.

- The counter processing prompts for customer an site information, to enable tracking revenue for a job code from the resulting invoice.

- Accounts Payable Invoices track expenses by prompting

for the customer, site, and cost code, for the expense to be

allocated as outlined in Job Costing Customer,

Site and Cost Codes.

Then when the A/P invoice is posted the expense is linked to the cost code. - G/L Journals and checks prompt for an optional cost code in order to capture any miscellaneous revenue or expenses that should be associated with a job.

- Employee timesheets will also prompt for a customer, site, and cost code, in order to track employee time and dollars to the job code.

Setting up Job Costing:

- Activate Enable Job Costing in Company Posting Parameters.

-

Set the two GL accounts used to manage Job Cost Payroll Expense and Job Cost Payroll Accrual in Default Accounts.

These accounts are utilized when posting employee hours in Post Time Clock/Cost Entries. -

Setup Site Managers and assign them to relevant sites in Customer Site Information.

-

Setup the Job Cost Codes with the pertinent values for each code.

-

Assign the Cost Codes to the sites in Estimated Billing window in the Customer Site Information with the number of units and the budgeted amount.

Job Cost Reporting: